For international traders, the export tax refund is like an old friend—you know it exists and hear about it often, yet its mechanics might remain unclear. Have you ever had any below questions?

If you have similar questions, let’s dive in!

Definition: Export tax refund, which can also be called export tax rebate, or duty drawback , is a governmental policy tool used to encourage exports by refunding taxes paid on materials or products that are intended for export.

Simply speaking, it is a governmental policy tool used to stimulate exports. When your goods are successfully exported, the government will refund a portion of the taxes paid on domestic sales to the exporting company.

There are 18 types of taxes in China, and export tax rebates mainly apply to two types of turnover taxes: consumption tax and value-added tax (VAT).

Duplication of taxes does not seem to be good news for consumers or exporters. So the reason for the tax refund jumps out.

Definition: Consumption tax/Excise Duty is a collective term for all kinds of taxes that take the turnover of consumer goods as the object of taxation, and it is a tax levied by the government on consumer goods, with a single levy link, most of which are paid at the production or import link.

In China, the scope of national consumption tax is relatively small, generally luxury goods, golf clubs, cigarettes, wine and so on.

The purposes are to increase fiscal revenue, and to discourage counterpart consumption by taxing luxury goods and high-grade consumer goods, so that those who consume these goods will bear more tax burden, thus reflecting the consumption policy, alleviating the inequality of social distribution, playing a regulating role, and promoting social fairness.

However, for those goods that are exported to foreign countries, it is likely that other countries will also impose consumption taxes on similar consumer goods.

The refund of the consumption tax can avoid the duplication of consumption taxes on the same consumer goods.

Definition:Value-added Tax (VAT) is a type of turnover tax levied based on the value added during the circulation of goods (including taxable services). As an indirect tax, VAT is calculated on the incremental value generated at each stage of production and distribution.VAT in China is usually between 6% and 13%.

VAT is an out-of-prices tax. It can be easily understood from the name, Value-added Tax (VAT), the price does not include value-added tax, but VAT will make the final consumer bear an added tax.

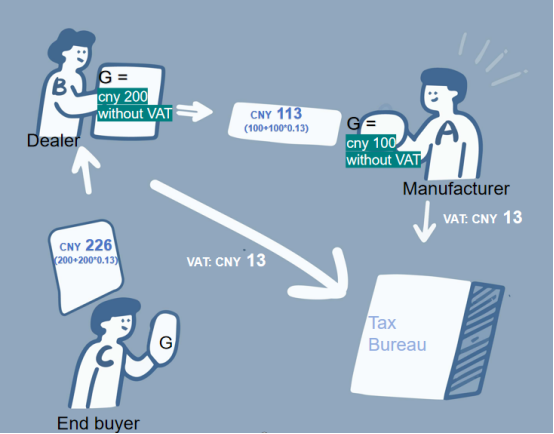

Here is an example to help understand why it is emphasized that the final consumer bears the VAT.

A is the manufacturer, B is the dealer, C is the end buyer and G represents the goods. By observation we can see that A got the goods worth 100 and B got the goods worth 200. C not only has to pay 200 for the value of the commodity itself, but also bears an additional tax of 26 for the commodity. Eventually, they purchase the commodity at a price of 226.

So we can conclude that with regard to VAT, all sellers in the sales chain act only as pro-forma payers and all VAT is actually paid by the end consumer.

There mainly two reasons:

1.Avoidance of double taxation: The final consumer in the importing country will thus bear a double tax burden: both the Chinese VAT, which is implicit in the price of the goods, and the VAT levied in the importing country. Avoiding double taxation can provide consumers with better prices and increase willingness to buy.

2.Improved fairness and competitiveness: International tax practice generally follows the principle of “taxation at the place of consumption”, which means that tax jurisdiction should be attributed to the place of final consumption of the goods or services.

The export tax rebate allows Chinese goods to enter the international market at a price that does not include China’s VAT, with the importing country taxing the final consumption behavior.

This is in line with the principle of tax neutrality, eliminates distortions in the prices of exported goods due to differences in tax regimes, maintains the fairness of international trade and enhances the competitiveness of China’s exported goods.

That’s why China is not the only country that has implemented an export tax refund policy; most of the major economies in the world have implemented it or similar policies in different forms. For example, in Europe, the VAT rebate policy is implemented, the United States has the Border Tax Adjustment, Japan has the JCT rebate, etc.

Opening up markets by avoiding double taxation can increase export trade, resulting in five significant benefits.

1.Increasing competitiveness in global markets

2.Promoting the diversification of exports is a key priority.

3.Vital to stimulate economic growth and employment.

4.Promoting the growth and development of small and medium-sized enterprises.

5.Promoting Technological Upgradation and Innovation

There are clear requirements for both the products and the enterprises if you want to do the export tax refund.

China’s Administrative Measures for Tax Refund and Exemption of Exported Goods specifies that for exported products, all products that have been or should be subject to value-added tax (VAT) and consumption tax (CST) shall be refunded or exempted from the taxes levied, except for those that the state explicitly stipulates that no tax refund shall be made.

To make it more clear, they should follow below requirements

1.Within tax scope: the exported goods are within the scope of VAT and consumption tax and belong to the products of tax refund.

2.Exported goods: the goods must be declared departure of the export of goods, the export of goods to the export processing zones bonded logistics parks and other customs supervision of the special closed area of the goods are also regarded as departure

3.Complete financial processing:some supporting evidences, like export sales contracts, foreign exchange income vouchers should be provided.

List of products not subject to tax rebate:

Category | Goods description |

Resources | Crude oil, gas |

Special trade | Foreign aid export goods |

Controlled goods | Goods prohibited to be exported by the state (e.g. natural cowhide, musk, unwrought copper and copper-based alloy, platinum, etc.) |

Iron and steel products | Specific types of steel (Note: the specific tax code is based on the annual “Catalog of Non-refundable Goods”) |

Military products | Exported products sold by munitions factories to the military system |

Diamond | Diamond processing enterprises directly export or sell diamonds processed from domestic/imported raw materials for export |

Some chemical products | Specific ethylene engineering products (Qilu, Yangzi, Daqing projects) |

According to the legal norms, the enterprise can be qualified for export tax rebate if all the following conditions are met.

1.The company’s business scope should have: “import and export of goods or technology” (China Industry and Commerce Bureau for the record)

2.Must be a general taxpayer, small-scale taxpayers can only export tax exemption, not tax rebates (China Tax Bureau).

3.Do have the right to import and export business: which contains the customs declaration unit for the record certificate, electronic port card application (International Trade Single Window) and foreign exchange directory registration (State Administration of Foreign Exchange).

4.Trade-oriented enterprises to do export tax rebates (exemptions) for the record, production-oriented enterprises to do export exemptions, credits, refunds for the record (Tax Bureau).

5.Customs declaration is made in the name of the enterprise independently, and the export documents are complete.

Common Question:

“When a Chinese supplier quotes me a price, as a foreigner, can I buy her tires and get a tax refund in order to have more profit?”

Answer:

Theoretically, the Chinese government does not restrict foreigners from exporting tax refund. If you and your goods fulfill the qualifications mentioned above, it is eligible for an export tax refund.

However, what is important in this case is what trade terms the supplier is offering:

We have to know refund tax rate. Please click here to quarry!

Take truck tires as example, if we input 401120, it will show 13% as result.

After know the refund tax rate, this questions may seem like quite simple. Just use price of goods multiply by the refund rate , then we will easily know how much tax refund we can get.

Is this correct? The answer is NO.

According to Chinese law, the amount of tax refund = FOB value of exported goods x exchange rate x tax refund rate.

Please note: that here is the FOB value as the base and the tax rebate rate is multiplied.

Here is a default formula for China’s foreign trade industry:

FOB price = RMB tax-inclusive price / (1 + tax refund rate) / exchange rate

Example:

Take tires as an example, VAT is 13% (0.13), assuming that its unit price in China is 100 yuan, the exchange rate of 7, then its FOB price in U.S. dollars as follows

FOB = 100/(1+0.13)/7=100/1.13/7~=USD12.642~=CNY88.49

Bringing in the data, we can get: Amount of tax refund = USD12.642*7*0.13~=$11.5

Let’s observe the answer, we can find that when the tax rebate rate is 13%,

Actual tax rebate amount = product tax-inclusive price * 0.115~ = FOB price (US Dollar) * 0.13 * exchange rate

Now we can see that using the tax-inclusive price multiplied by the tax rate doesn’t give us the right tax refund amount. Don’t worry, we’ve got your back!

The correct formula for calculating the tax rebate amount is always the same:

Tax refund = FOB value * exchange rate * tax refund rate

This policy facilitates the movement of goods across international borders, offering consumers a wider selection, fostering economic growth, strengthening international trade relations, and promoting global economic prosperity.

Should you have any further questions, please do not hesitate to get in touch with our TNR team!