Import duties, essentially taxes levied on imported goods, serve as a critical component of international trade. They are used by governments to control the economic impact of imported goods, protect domestic industries, and generate revenue. The rates can vary based on the product type, origin country, and destination market.

Are you still not aware of the tariffs on the tires you plan to buy? Don’t worry, let’s learn together today how to check the tariff.

HS Code

It is necessary to know the Commodity HS Code before understanding the tariffs. I list some HS Codes for your reference.

HTS Code | Goods Description |

4011 | New pneumatic tires of rubber |

4011.10 | New pneumatic tires of rubber used on motor cars, including station wagons and racing cars |

4011.20 | New pneumatic tires of rubber used on buses or trucks |

4011.30.00 | New pneumatic tires of rubber used on aircraft |

4011.40.00 | New pneumatic tires of rubber used on motorcycles |

4011.50.00 | New pneumatic tires of rubber used on bicycles |

4011.70.00 | New pneumatic tires of rubber used on agricultural or forestry vehicles and machines |

4011.80 | New pneumatic tires of rubber used on construction, mining or industrial handling vehicles and machines |

4011.90 | New pneumatic tires of rubber used on other machines and vehicles. |

Please note that HS codes may vary from country to country, please log on to the official website of your destination country for correct HS codes.

It is important to note that all import taxes are made up of three parts, consisting of three parts, customs rate, anti-dumping duties, and VAT.

Customs rate

This article will talk about Normal customs rate from the RCEP and the EU.

Duty for RCEP member countries

RCEP members has 15 countries including Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam, China, Japan, South Korea, Australia and New Zealand.

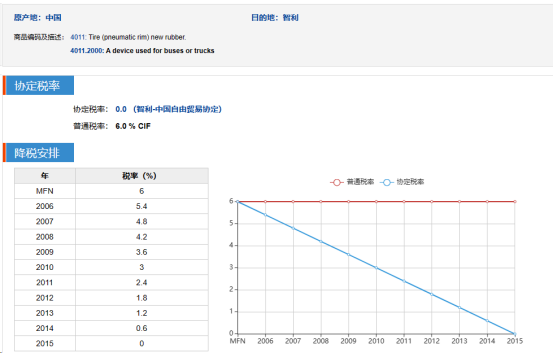

If the importing and exporting countries are both RCEP, please follow the steps below to check the tariff.

Step 1

Visit the website http://fta.mofcom.gov.cn/ and you’ll see the query interface shown in the following image

Step 2

Click the drop-down option in the “Country of Origin” column and select the country of origin of the product.

Click on the drop-down option in the “Destination” column and select the destination of the product.

Step 3

Enter the HS Code

(If you don’t know the HS Code, you can click the to search HS Code button)

Step 4

Click Query

As shown in the figure above, in the case of China as the country of origin and Chile as the destination country, and the HS code is 40112000, the minimum tax rate is 0, then the tariff on this order is zero.

Duty for EU countries

The 27 countries of the European Union are: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Romania, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain and Sweden.

Products imported from non-EU countries are subject to the same import duties regardless of the country in which they enter the EU.

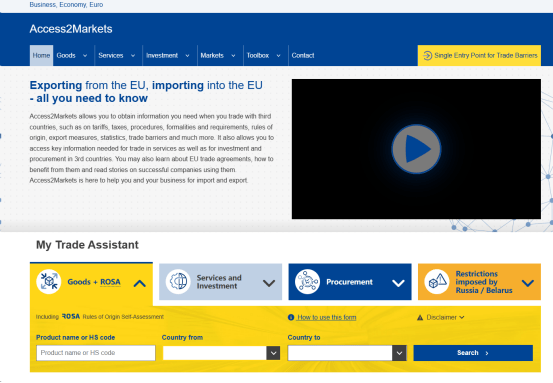

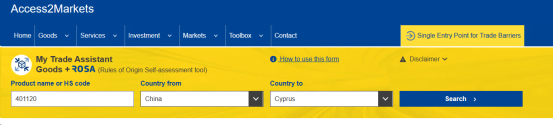

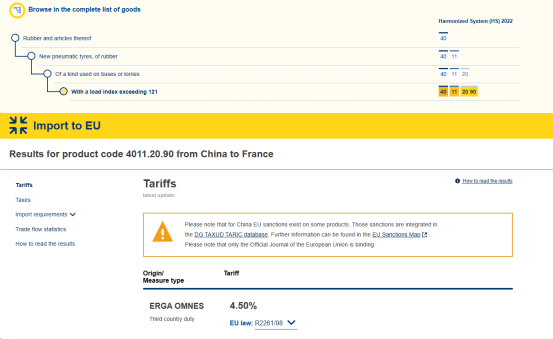

Step 1

It is recommended to visit the website

Step 2

Please fill in the information, e.g. HS code, country of origin, country of delivery,then click “Search”.

Step 3

It is clear for us to see the customs duty is 4.5%.

For customers in other countries, you can also check the tax rate through HS Code by visiting the official website of the national government.

VAT

Definition: A value-added tax, or VAT, is a tax on products or services when sellers add value to them. In some countries, VAT is called goods and services tax, or GST.

VAT varies from country to country over the world. There is a table for the EU below for your reference.

Member States | Code | Standard |

VAT Rate | ||

Belgium | BE | 21 |

Bulgaria | BG | 20 |

Czech Republic | CZ | 21 |

Denmark | DK | 25 |

Germany | DE | 19 |

Estonia | EE | 20 |

Ireland | IE | 23 |

Greece | EL | 24 |

Spain | ES | 21 |

France | FR | 20 |

Croatia | HR | 25 |

Italy | IT | 22 |

Cyprus | CY | 19 |

Latvia | LV | 21 |

Lithuania | LT | 21 |

Luxembourg | LU | 17 |

Hungary | HU | 27 |

Malta | MT | 18 |

Netherlands | NL | 21 |

Austria | AT | 20 |

Poland | PL | 23 |

Portugal | PT | 23 |

Romania | RO | 19 |

Slovenia | SI | 22 |

Slovakia | SK | 20 |

Finland | FI | 24 |

Sweden | SE | 25 |

United Kingdom | UK | 20 |

For example, when a batch of truck tires are imported to Germany, the VAT in Germany is 19%. Then in the case of the value of the goods is 20,000 euros and the sea freight is 500 euros, the VAT of this batch of goods is 3,895 euros.

(2,000 euros + 500 euros) * 0.19 = 3,895 euros

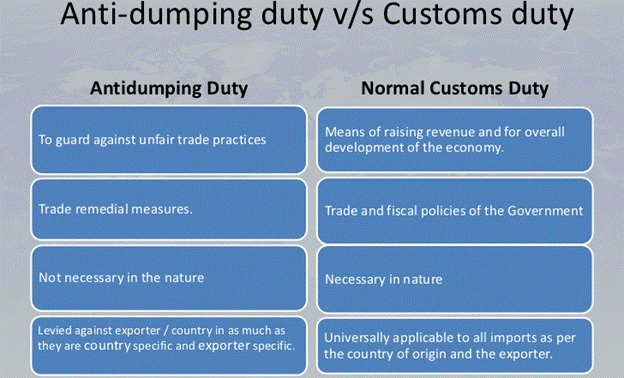

Anti-dumping duty and Anti-subsidy duty

Anti-dumping Definition: An anti-dumping duty is a protectionist tariff that a domestic government imposes on foreign imports that it believes are priced below fair market value.

Anti-subsidy duty Definition: Anti-subsidy duties, also known as Countervailing duties (CVDs) , are trade import duties imposed under World Trade Organization (WTO) rules to neutralize the negative effects of subsidies. They are imposed after an investigation finds that a foreign country subsidizes its exports, injuring domestic producers in the importing country.

These two taxes are a bit more special than the other two mentioned. Each country has its own tax standards for products from different countries of origin, and some countries even have different tax standards for different manufacturers.

The figure below shows Brazil’s list of anti-dumping duties on Chinese truck and bus tires

These two taxes are a more special than the other two mentioned. Each country has its own tax standards for products from different countries of origin, and some countries even have different tax standards for different manufacturers.

The table below shows Brazil’s list of anti-dumping duties on Chinese truck and bus tires.

Anti-dumping duty for Truck and bus tires imported from China to Brasil according to tire weight, USD/KG | |

Manufacturer Name | Antidumping Duty |

Shandong Linglong Tyre Co, Ltd | 1.05 |

Triangle Tyre Co., Ltd. | 1.17 |

Zhongce Rubber Group Co, Ltd | 1.12 |

Double Coin Holdings Ltd | 1.12 |

Giti Radial Tire (Anhui) Co. Ltd. | 1.31 |

Giti Tire (Chongqing) Company Ltd | 1.31 |

Giti Tire (Fujian) Company Ltd | 1.31 |

Aeolus Tyre Co., Ltd. | 1.42 |

Chaoyang Long March Tyre Co., Ltd | 1.42 |

Cooper Chengshan (Shandong) Tire Company Ltd | 1.42 |

Guangming Tyre Group Co., Ltd | 1.42 |

Jiangsu Hankook Tire Co., Ltd | 1.42 |

Michelin Shenyang Tire Co.,Ltd | 1.42 |

Pirelli Tyre Co., Ltd | 1.42 |

Sailun Co..Ltd | 1.42 |

Sailun Jinyu Group Co.,Ltd | 1.42 |

Shandong Jinyu Tire Co., Ltd | 1.42 |

Shandong Changfeng Tyres Co., Ltd | 1.42 |

Shandong Wanda Boto Tyre Co., Ltd | 1.42 |

Shenyang Peace Radial Tyre Manufacturing Co., Ltd | 1.42 |

Triangle(Weihai) Huamao Rubber Co., Ltd | 1.42 |

Zhaoging Junhong Co.,Ltd | 1.42 |

Shandong Bayi Tyre Manufacture Co., Ltd | 1.55 |

Shandong Hengyu Rubber Co., Ltd | 1.42 |

Shandong Longyue Rubber Co., Ltd | 1.42 |

Shouguang Firemax Tyre Co., Ltd | 1.42 |

Sinotyre International Group Co., Ltd | 1.42 |

Other manufacturer | 2.59 |

If you still have questions about the tax on tires, please don’t hesitate to contact us. We will provide you with professional services based on your information.