In today’s globalized business environment, the Letter of Credit (L/C), as an internationally recognized payment instrument, provides both buyers and sellers with secure and standardized settlement assurance by incorporating bank credit. It serves as a reliable bridge facilitating international trade.

This article offers a comprehensive overview of Letters of Credit, with a particular focus on Sight Letters of Credit.

I. Basic Concepts and Main Classifications of Letters of Credit

a. Definition of a Letter of Credit (L/C):

A Letter of Credit is a conditional payment undertaking issued by the issuing bank (the buyer’s bank) at the request of the buyer (importer) in favor of the seller (exporter). In international trade, an L/C essentially represents a mechanism whereby bank credit replaces commercial credit, thereby addressing the fundamental issue of mutual distrust between the buyer and the seller.

b. Main Classifications of L/C

Letters of Credit are primarily classified into two main categories: Sight Letters of Credit and Usance (or Deferred Payment) Letters of Credit.

Types of LC

Payment Time

Proportion

in Tire Trade

Sight L/C

Payment will be made by the bank within 5 business days of receiving compliant documents.

>95%

Usance L/C

The bank commits to payment on the agreed date (e.g., 30, 60, or 90 days later).

<5%

II.Basic Concept and Advantages of a Sight Letter of Credit

a. Basic Concept of Sight L/C

A Sight Letter of Credit (L/C at sight) is a payment instrument under which the issuing bank or paying bank immediately fulfills its payment obligation upon receipt of documents and a draft that comply with the terms of the credit. Its core feature is “payment upon presentation of compliant documents”.

b. Advantages of a Sight L/C

-

Control over ownership of goods:

Under a Sight Letter of Credit, the bill of lading (B/L) is usually held by the bank. The importer must make payment before redeeming the documents, ensuring that payment is made only after confirming that the goods meet the contractual requirements. -

Simplified customs clearance:

The importer can use the complete set of documents obtained from the issuing bank (e.g., bill of lading, commercial invoice, certificate of origin) to proceed with customs clearance, avoiding delays or penalties caused by missing or non-compliant documents. -

Access to trade financing:

Importers may arrange for import financing (e.g., banker’s acceptance) with the bank, enabling them to pay for the goods and obtain the documents in advance, take delivery of the goods, and repay the bank after collecting payment from sales.

-

Enhanced payment security

Exporters do not rely on the importer’s commercial credit. Instead, they benefit from the guarantee of the issuing bank — typically a reputable financial institution in the importer’s country — significantly reducing payment risk.

-

Significantly minimize order-related disputes:

The terms of the Letter of Credit clearly specify key elements such as the description of goods, documentary requirements, and shipment deadlines. As long as the exporter strictly complies with these terms and prepares the documents accordingly, disputes arising from ambiguous contract clauses — such as discrepancies in tire specifications or origin certification — can be avoided.

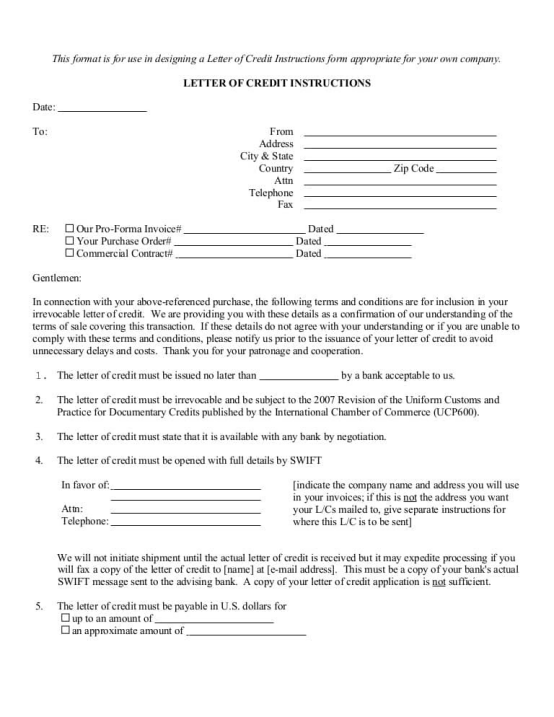

III. Letter of Credit Process

The buyer and seller clearly agree in the trade contract to use a Sight Documentary Letter of Credit as the payment method, and specify key details such as documentary requirements and shipment deadlines.

The importer completes a Letter of Credit Application and submits supporting documents, including the trade contract, import license, and company qualification certificates, to the issuing bank. A deposit (ranging from 0% to 30% of the L/C amount) is also paid, depending on the importer’s credit standing.

The issuing bank sends the L/C to the advising bank via the SWIFT system (in MT700 format). The advising bank verifies the apparent authenticity of the L/C (e.g., through cipher codes or signature stamps), collects an advising fee (approximately CNY 200), and then forwards the L/C to the beneficiary.

The exporter carefully reviews the L/C for key terms, such as the expiry date and shipment deadline, and verifies whether the documentary requirements are feasible (e.g., type of bill of lading, certification documents). If discrepancies are found, the beneficiary must request amendments immediately, which require the consent of all relevant parties.

The exporter arranges shipment in accordance with the requirements of the Letter of Credit and prepares the full set of required documents, which typically include:

Bill of Lading (B/L)

Commercial Invoice

Packing List

Certificate of Origin (CO)

Inspection Certificate (e.g., SGS Report), if required

The exporter submits the documents to the presenting bank or nominated bank, preferably a bank with which the beneficiary has an established relationship.

The issuing bank or nominated bank examines the documents within 5 business days based on the principle of “apparent compliance” (reviewing documents only, without inspecting the goods themselves). Once the documents are confirmed to be in compliance, the issuing bank must make payment promptly.

The issuing bank reimburses the paying or negotiating bank. The importer then makes payment to redeem the documents (if the full deposit was not paid at the time of L/C issuance).

- In the event of an unjustified refusal of payment by the issuing bank, the beneficiary may seek arbitration through the International Chamber of Commerce in accordance with UCP 600.

IV. Key Risks in Letter of Credit Operations and Mitigation Strategies

Types of Risks

-

Documentary Discrepancies: Examples include incorrect consignee name on the bill of lading, invoice amount not matching the Letter of Credit, and other inconsistencies in required documents.

-

Soft Clause Traps: Unreasonable conditions embedded in the L/C (e.g., requiring buyer’s signature for document acceptance) that make it difficult or impossible for the beneficiary to fulfill the terms.

- Exchange Rate Fluctuations: Currency market volatility may impact profitability, especially when the local currency depreciates or appreciates significantly against the settlement currency

Risk Avoidance Strategies

-

Conduct Strict L/C Examination: Upon receipt of the Letter of Credit, carefully review all terms line by line, with particular attention to shipping conditions, documentary requirements, and the validity period.

-

Opt for a Confirmed L/C: If the creditworthiness of the issuing bank in the buyer’s country is in doubt, request a confirmed Letter of Credit to obtain an additional guarantee from a reputable bank.

- Utilize Financial Instruments: Use forward foreign exchange contracts to lock in exchange rates and hedge against currency fluctuation risks.

V. Conclusion

The Letter of Credit, especially the Sight Letter of Credit, is an indispensable risk management tool in tire trade. Through standardized procedures and effective risk control, businesses can achieve secure and efficient cross-border transactions. With the advancement of digital technologies, Letters of Credit are expected to further streamline processes and support the tire industry in maintaining stable growth in the global market.

FAQs on Letter of Credit

Yes. Letters of Credit (LCs) are a secure payment method commonly used in international trade.

Typically 1% of the contract value. Costs can range from 0.25% to 2% based on specific factors.

Most LCs are irrevocable and cannot be cancelled unless all parties agree.

Yes. To discount an LC, the holder (supplier) must confirm the issuing bank is approved by the discounting bank. Once approved, the discounting bank pays out funds minus a fee.

Yes. LCs are negotiable instruments. Banks deal with documents, not goods, allowing transfer with party consent.

It can be. For the issuing bank, it becomes a liability only if the buyer defaults on payment.

a. Without recourse: Applies to the beneficiary of a confirmed LC.

b. With recourse: Applies to the beneficiary of an unconfirmed LC.

a. The issuing bank pays if the importer fails.

b. For a confirmed LC, the confirming bank pays if both the importer and issuing bank default.